nso stock option tax calculator

How much are your stock options worth. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

What Are Non Qualified Stock Options Nsos Carta

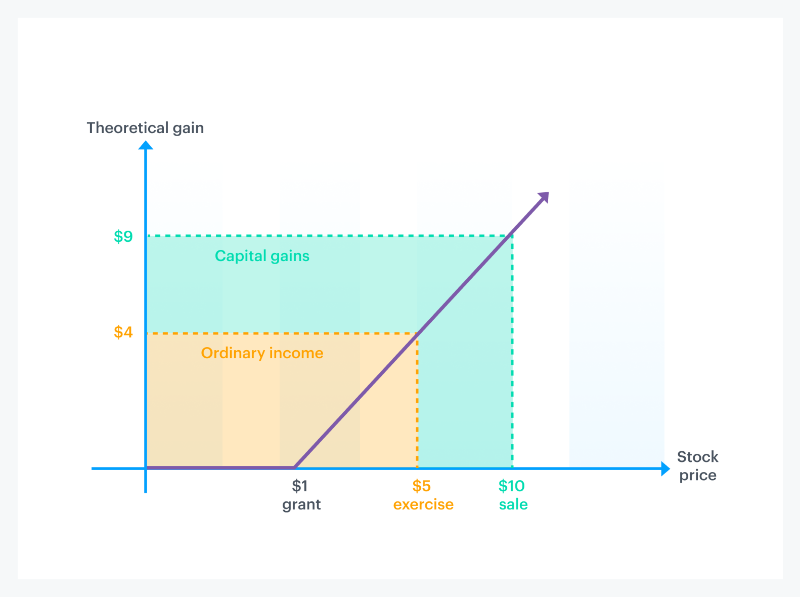

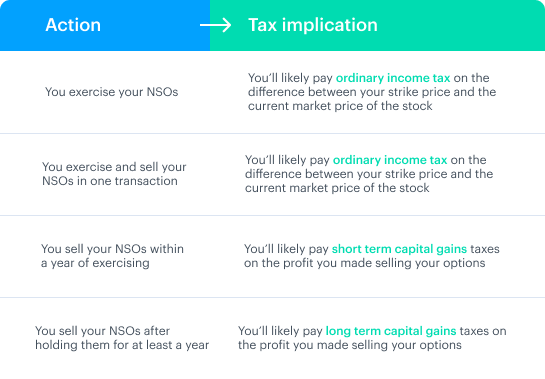

A non-qualified stock option NSO is a type of employee stock option where you pay ordinary income tax on the difference between the grant.

. Both an ISO and an NSO are restricted stock. Click to follow the link and save it to your Favorites so. I would assume being an.

NA not sold yet Number of shares. On this page is a non-qualified stock option or NSO calculator. January 29 2022.

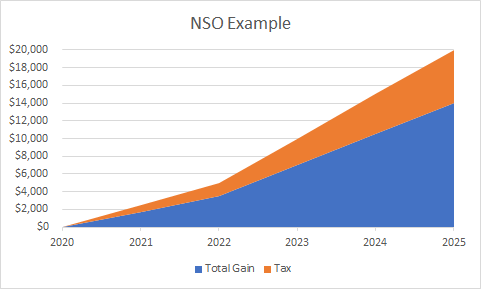

This calculator can be used to estimate the number of shares you may own after you do a cashless exercise net-exercise of non-qualified stock options. An NSO gives recipients the choice to purchase. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs.

A stock option is not the same as a share of stock. This permalink creates a unique url for this online calculator with your saved information. On this page is a non-qualified stock option or NSO calculator.

Youve made a 81 net gain on your NSO 150 52 sale tax 17. It is also a type of stock-based compensation. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options.

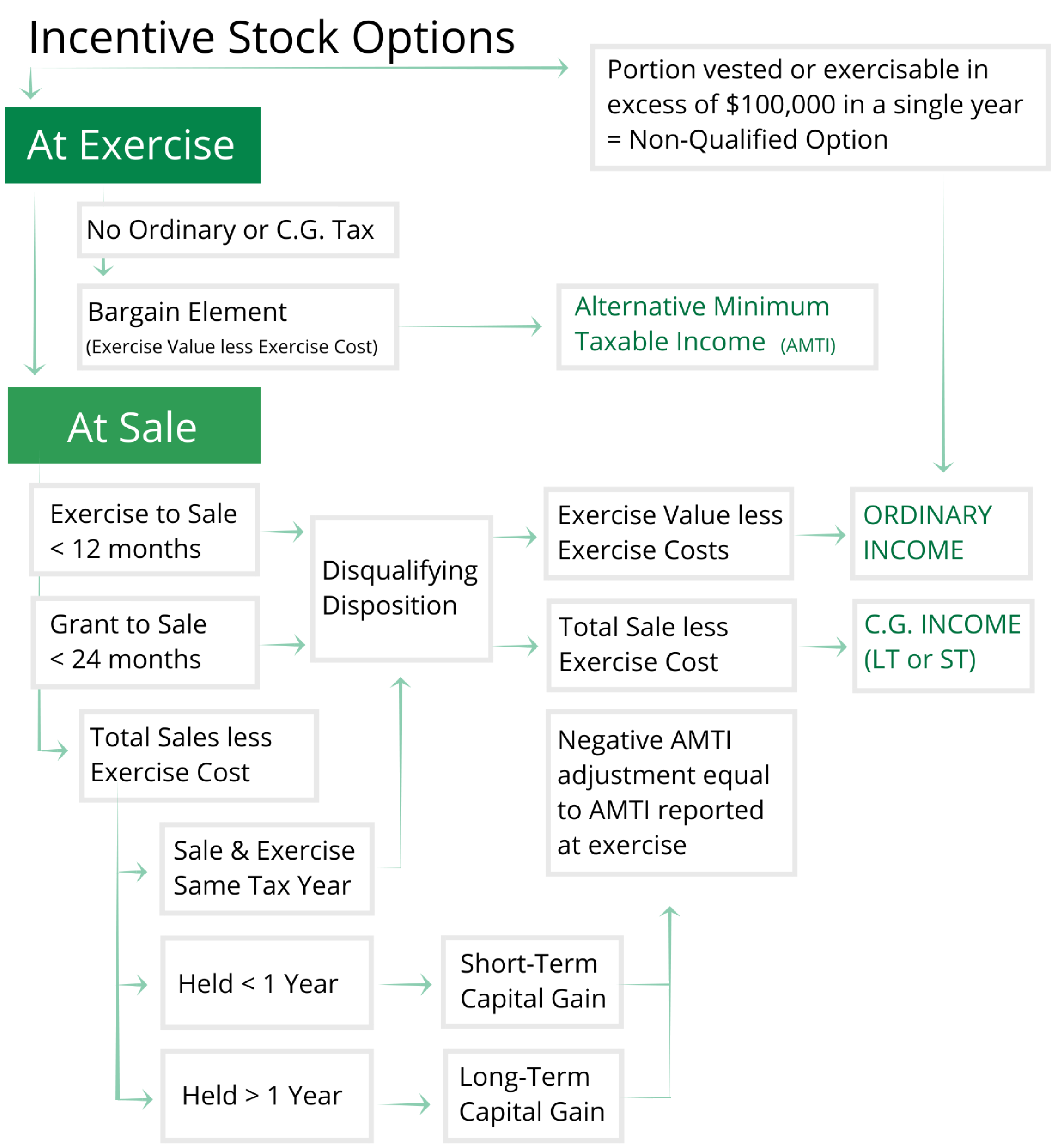

ISOs are attractive due to their preferential tax. This explains why employee stock options are a type of deferred compensation used to motivate and retain employees. Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you.

NSOs do not require employment and. Calculate the costs to exercise your stock options - including taxes. Stock Option Tax Calculator.

In the event that you are unable to calculate the gain in a particular exercise scenario you can use the. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. The tool will estimate how much tax youll pay plus your total return on your non.

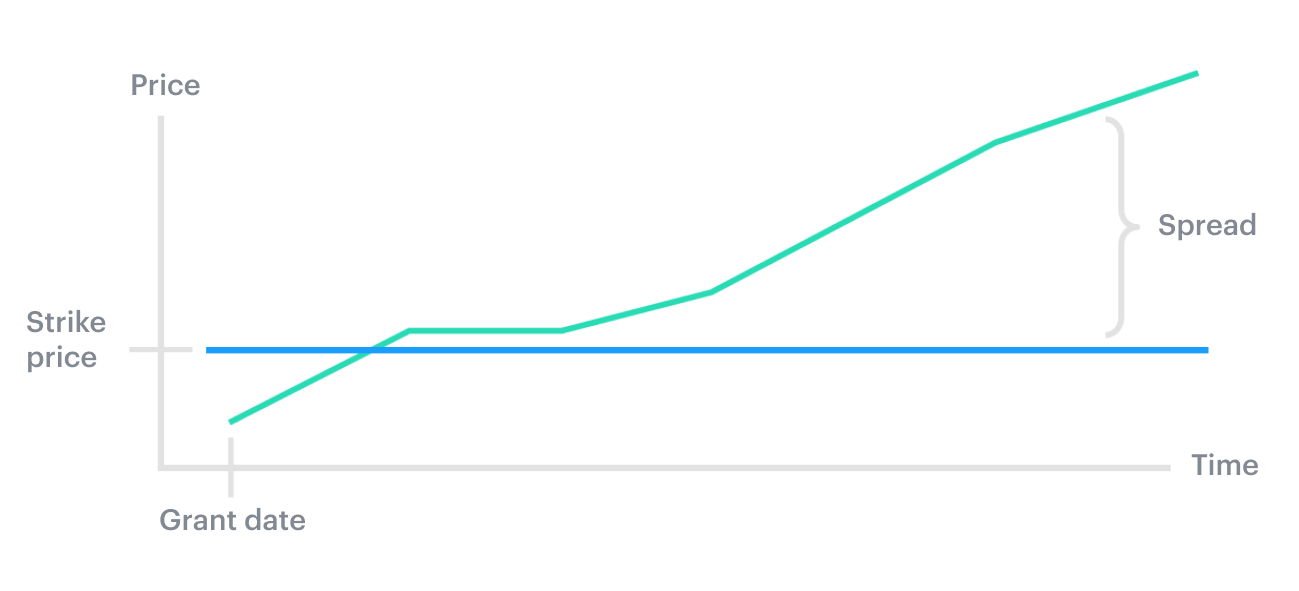

A NSO is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the exercise or strike price. Non-Qualified Stock Option - NSO. Redirecting to learnnso-non-qualified-stock-options-tax-treatment 308.

A NSO is a type of. The tool will estimate how much tax youll pay plus your total return on. A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees.

Non qualified stock option NSO is one where employees are taxed both while purchasing the stock exercising options as well as while selling the stock. Of course the stock price could fall back to. A stock option is a right to buy a set number of shares of the companys stock at a set price the exercise price within a fixed period of.

The stock option agreement refers to the plan as an Incentive Stock Option ISO plan even though I was an Independent Contractor for the company. A non-qualified stock option NSO is a form of equity compensation that can be provided to employees and other stakeholders. The tool will estimate how much tax youll pay plus your total return on your.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Stock plans including the non-incentive stock option NSO allow employees to purchase shares of the company at a set price FMV on specific dates to potentially maximize their earnings. NSO Tax Occasion 1 - At Exercise.

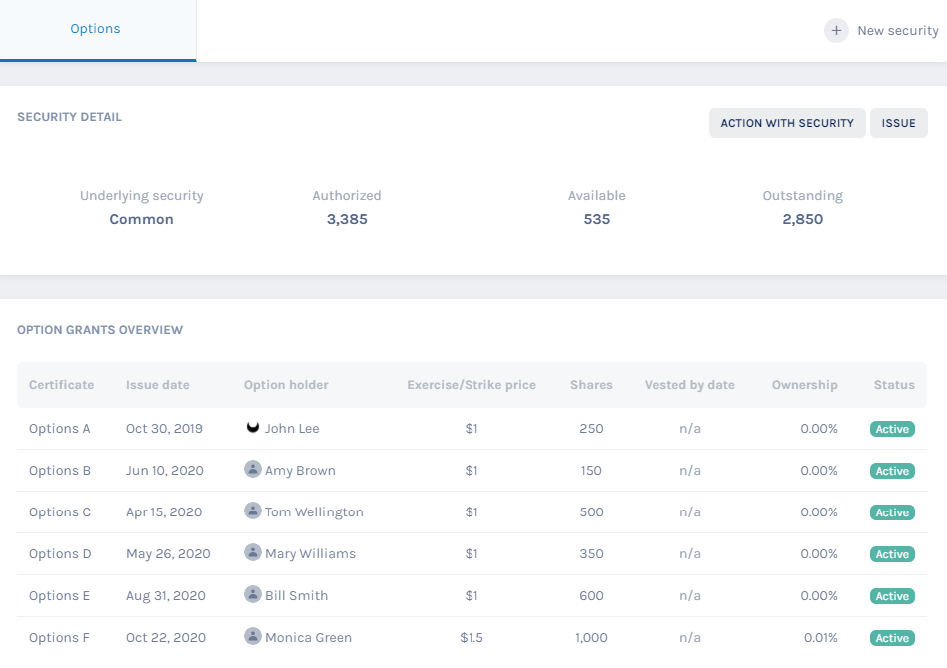

Whiteland Business Park 740. Test out various options strategies and discover the contract size that works best for you. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

On this page is an Incentive Stock Options or ISO calculator. The calculator is very useful in evaluating the tax implications of a NSO. The Stock Option Plan specifies the total number of shares in the option pool.

On this page is a non-qualified stock option or NSO calculator. If either is exercised early the holders of these stocks have to pay capitál gains tax whether or not they received cash or just. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share.

How Much Are My Options Worth Eso Fund

Nonqualified Stock Option Nso Tax Treatment And Scenarios Equity Ftw

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

What Are Non Qualified Stock Options Nsos Carta

Guide To Nonstatutory Stock Options Nsos Personal Capital

Nso Or Non Qualified Stock Option Taxation Eqvista

Should I Take An Nso Extension

How Stock Options Are Taxed Carta

When Should You Exercise Your Nonqualified Stock Options

Restricted Stock Units Jane Financial

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Non Qualified Stock Option Nso Basic Guide

Stock Options 101 The Essentials Mystockoptions Com

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

When Should You Exercise Your Nonqualified Stock Options